How New 2025 Tax Laws Could Benefit Homeowners and Real Estate Investors

What this 2025 Tax Reform Means for Homeowners and Buyers

In July 2025, Congress passed a sweeping tax reform package that brings meaningful benefits to homeowners, real estate investors, and small business owners alike. If you're buying a home, selling one, or just curious about how these changes might impact your long-term financial picture, here’s a simplified breakdown of what you need to know:

1. Mortgage Interest Deduction Made Permanent

Good news for homeowners: the mortgage interest deduction (MID) is now permanent. This allows homeowners to continue deducting mortgage interest on their taxes, a significant financial benefit when owning a home.

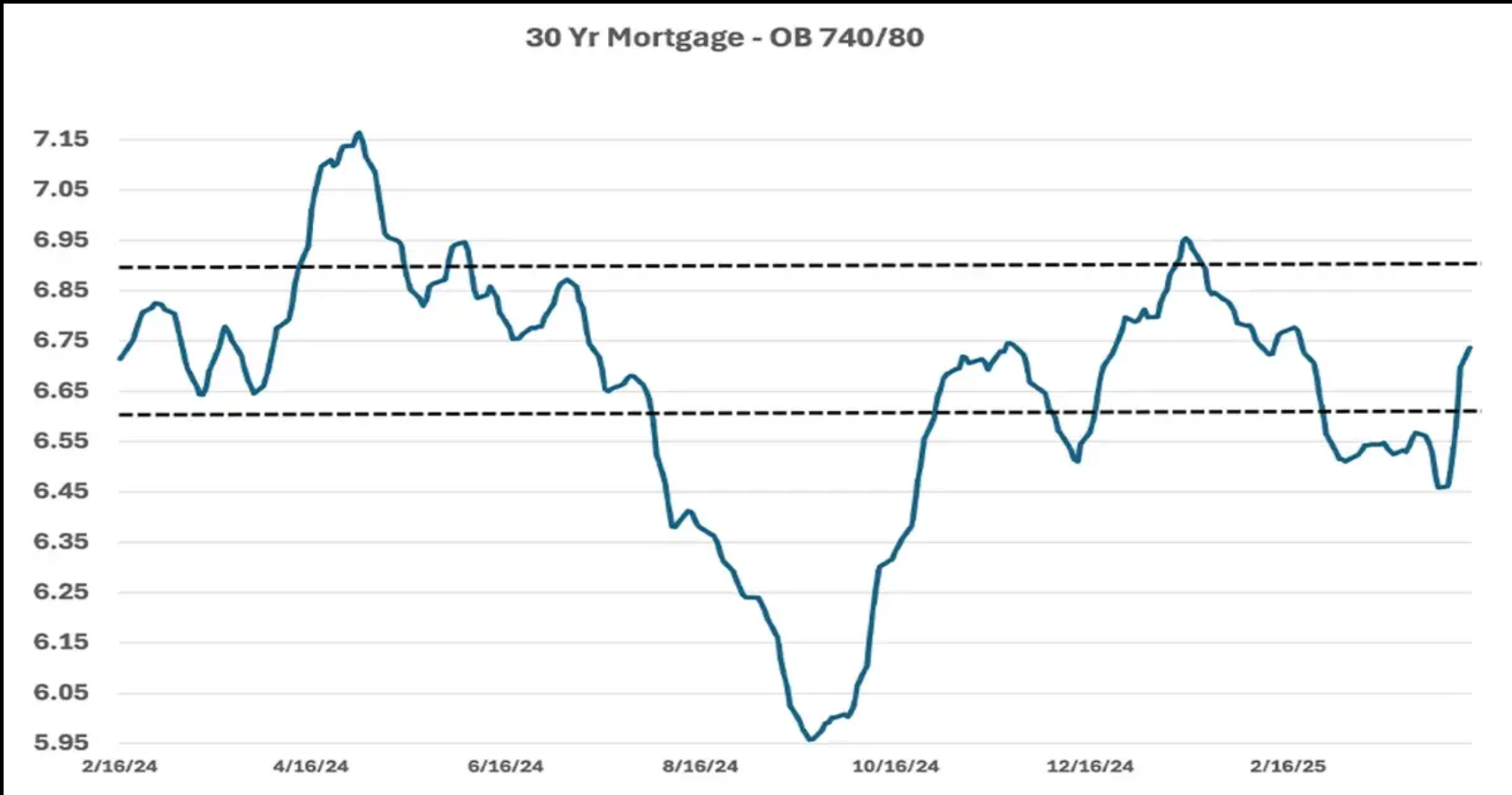

2. Seller-Paid 2:1 Buydowns and Lower Payments

While not directly part of the new tax laws, 2:1 buydowns—where sellers cover costs to temporarily lower a buyer's interest rate—are more popular than ever. With lower upfront payments, buyers are better positioned to manage early ownership costs, especially when paired with the new tax incentives.

3. State and Local Tax (SALT) Deduction Expanded

For households earning under $500,000, the cap on state and local tax (SALT) deductions has been raised from $10,000 to $40,000 through 2030. This especially benefits buyers in higher-tax areas, potentially reducing their overall tax burden.

4. More Relief for Small Business Owners & Independent Contractors

Over 90% of real estate professionals are classified as small businesses or independent contractors. The Qualified Business Income Deduction has been increased from 20% to 23%—a permanent change offering tax relief to agents, investors, and other self-employed professionals.

5. Expanded Low-Income Housing Tax Credit (LIHTC)

This bill also aims to boost affordable housing by improving and expanding the Low-Income Housing Tax Credit. It’s expected to help create or preserve over 1 million affordable rental homes over the next decade—a positive step toward addressing the nation’s housing supply challenges.

6. Estate and Gift Tax Exemption Increased

The estate and gift tax exemption is now permanently set at $15 million, adjusted for inflation. This helps property owners pass down wealth and real estate assets more efficiently to future generations.

7. Why This Matters for Buyers and Sellers

- Buyers can benefit from lower monthly payments (through buydowns or deductions), and long-term tax advantages through the MID and SALT deductions.

- Sellers might find buyers more motivated, as temporary buydowns become a negotiating tool.

- Investors and self-employed professionals in real estate see more substantial tax relief.

Bottom Line: Real Estate Just Became a Smarter Investment

Whether you’re looking to buy, sell, or invest, these tax reforms make real estate more attractive. From immediate affordability through seller-paid buydowns to long-term savings with expanded deductions, 2025’s Big Beautiful Bill could reshape your financial strategy around homeownership.

Let’s Talk About Your Next Move

These new tax benefits could open doors for you—literally. Whether you're curious, confused, or ready to act, I'm here to help you understand your options and make the most of Charleston’s real estate market.

Reach out anytime. Let’s find your best move together.

*Summary reported from my personal understanding surrounding the new bill and it's impact. This article should not be taken as tax advice. For a comprehensive understanding, read the article here: