Mortgage Rates Ease: What It Means for the Charleston Real Estate Market

Mortgage Rates Dip Nationally—Charleston Market Holds Strong

National interest rate changes meet local realities: how buyers & sellers in Charleston should respond

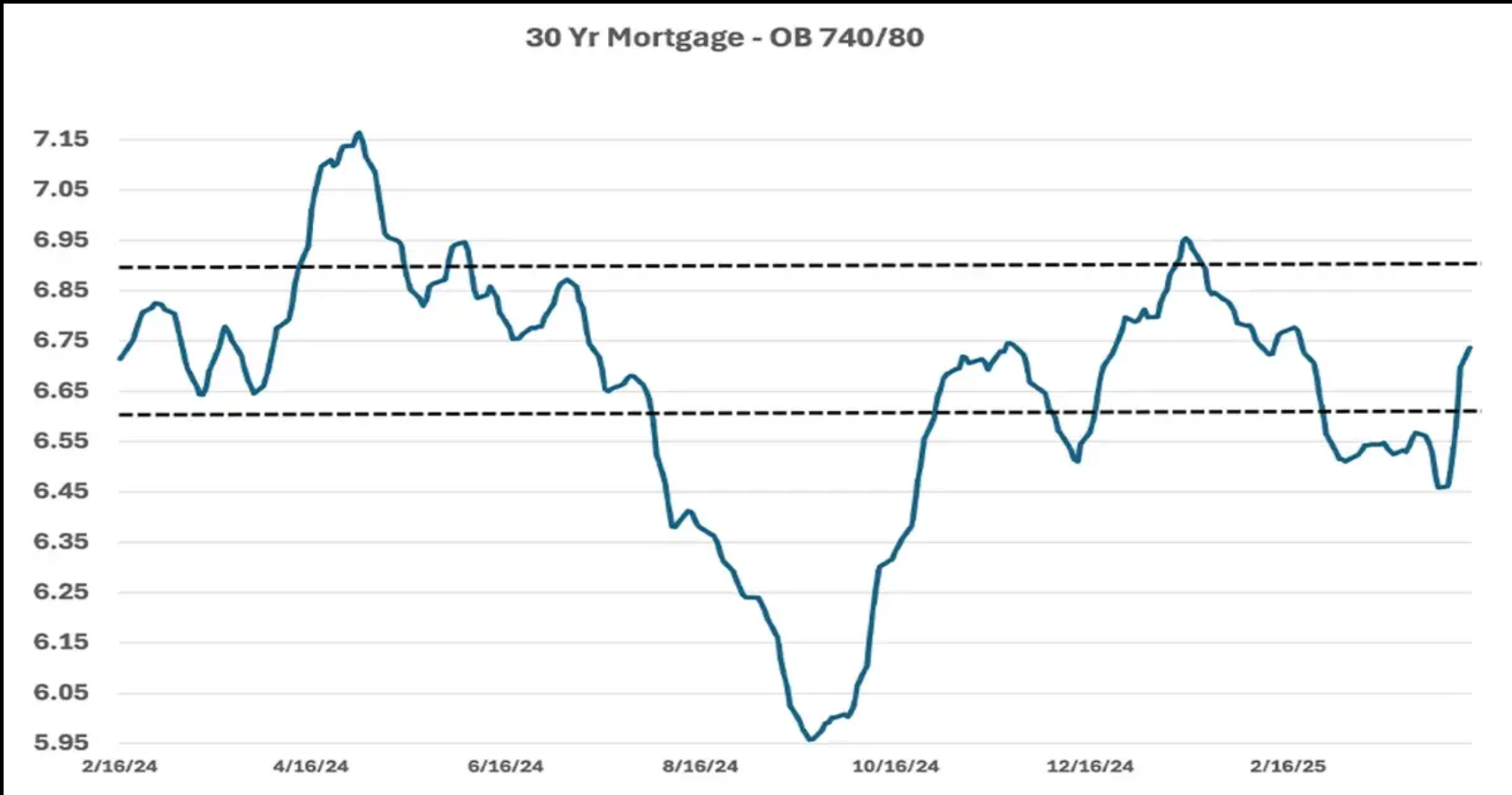

Mortgage rates are now hovering in the mid-6 percent range, offering a renewed glimmer of hope for buyers nationwide. According to the National Association of REALTORS® (NAR), the 30-year fixed-rate mortgage averaged 6.58% last week, down from 6.63%—the lowest level since October 2024. This dip has already spurred a 17% increase in purchase applications compared to the same time last year.

NAR’s deputy chief economist Jessica Lautz noted that buyers may now be in a “sweet spot” with slightly better rates and more housing inventory. Regionally, adjustable-rate mortgages (ARMs) have become more popular, with ARM applications surging 25% to their highest level since 2022.

Nationally, the lower borrowing costs could open refinancing opportunities, boost inventory as more homeowners feel confident listing, and help buyers access homes that previously felt out of reach. That said, analysts caution that mortgage rates are still tied to long-term Treasury yields, and predicting rate moves beyond minor shifts is uncertain at best.

Charleston Market Snapshot (July 2025)

While national headlines grab attention, Charleston continues to carve its own path. Here’s what the July numbers reveal about our local market:

- Written (Ratified) Sales: 262 properties went under contract last week, up 23% year-over-year.

- Closed Sales: July closings totaled 1,721, a 4% increase from July 2024.

- Monthly Written Sales: Ratified contracts finished 3% lower than last July, signaling the expected seasonal slowdown—but this does not mean opportunity has dried up. The Charleston market still has plenty of momentum heading into the fall.

- Mortgage Rates: Locally, rates have dipped to their lowest level since last fall.

- Median Sale Price: July’s median price held steady at $430,000, the second-highest level on record, continuing the stable pricing trend Charleston has maintained for the past three years.

- Sold $/Sqft: July set an all-time high for average sold dollar per square foot. Buyers are paying more per square foot, which suggests steady appreciation even as median pricing remains flat.

- Active Inventory: Mid-July inventory stood at about 5,140 listings. While that’s a big jump from the “floor” of just over 1,000 listings in February 2022, Charleston still needs about 3,500 more listings to reach balanced market conditions.

- New Listings: Roughly 2,300 new homes came to market in July, a 5% increase from the year prior.

- Weeks of Inventory: At roughly 12 weeks of supply, Charleston remains in a seller’s market, though levels can vary by price range and micro-market.

Final Takeaway

Whether you’re reading national headlines or following the green line of Charleston contracts, the story is clear: opportunity is still on the table. A modest drop in mortgage rates isn’t just a statistic—it’s creating real momentum in buyer activity both nationally and here at home.

For Charleston buyers, waiting for rates to “drop dramatically” may mean missing today’s opportunities. If rates go down after closing, refinancing is always an option. If they stay flat, you’ve locked in a fair rate. If they rise, you’ll be glad you moved sooner.

For sellers, the stability of prices and the steady climb in price per square foot underscores continued strength in the market.

Bottom line: Charleston is not simply echoing the national story—it’s holding its own and, in many ways, outperforming. If you’re considering buying, selling, or investing in 2025, now is the time to have a strategy, not sit on the sidelines.

I’m here to help you navigate the market frame by frame—let’s connect to discuss your goals.

Sources

- National Association of REALTORS®, Mortgage Rates Fall: Is It Enough for Buyers?, August 2025

- Charleston MLS July 2025 Market Data

- Federal Reserve Bank of St. Louis, 30-Year Fixed Rate Mortgage Average (MORTGAGE30US)