What Every Charleston Homeowner Needs to Know About Their Equity

Are You Sitting Pretty — or Just Sitting on Equity?

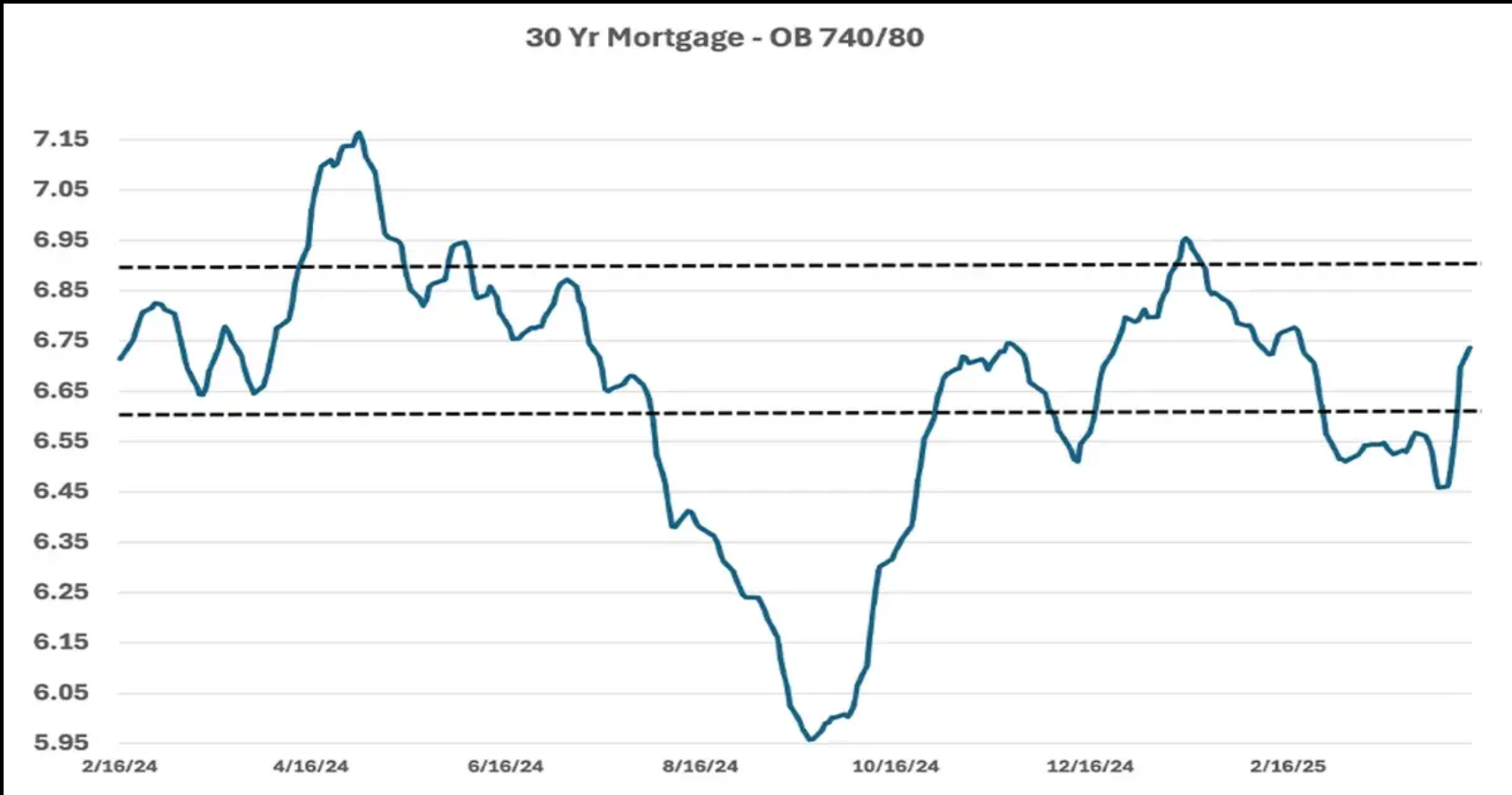

If you’ve been holding onto a home longer than planned, unsure if now is the right time to sell, you’re definitely not alone. Many Charleston-area homeowners hesitate—not because their current home fits their future—but because higher mortgage rates on a new purchase feel like a heavy lift.

Here’s the thing: while interest rates fluctuate, home prices—especially in Charleston—have a strong, long-term upward trend.

📈 A Look at Price Growth Across Charleston

Across the Charleston region, home values have surged significantly over the past two decades- fueled by demand, limited inventory, and our unique coastal appeal.

Here’s a snapshot of average home price growth in several key markets:

📊 Home Price Growth Snapshot Across the Charleston Market

Charleston Metro

2005: $310,000

2010: $340,000

2015: $395,000

2020: $480,000

2025 (Projected): $900,(864) 420-3054%)

Mount Pleasant

2005: $366,000

2010: $398,000

2015: $471,000

2020: $570,000

2025 (Projected): $1,160,(864) 420-3054%)

Daniel Island

2005: $320,000

2010: $350,000

2015: $410,000

2020: $510,000

2025 (Projected): $1,000,(864) 420-3054%)

Isle of Palms

2005: $450,000

2010: $480,000

2015: $560,000

2020: $720,000

2025 (Projected): $1,200,(864) 420-3054%)

Johns Island

2005: $275,000

2010: $300,000

2015: $350,000

2020: $425,000

2025 (Projected): $700,(864) 420-3054%)

West Ashley

2005: $240,000

2010: $260,000

2015: $300,000

2020: $375,000

2025 (Projected): $650,(864) 420-3054%)

Downtown Charleston

2005: $450,000

2010: $475,000

2015: $520,000

2020: $610,000

2025 (Projected): $1,100,(864) 420-3054%)

💡 What This Means for You as a Homeowner

- Equity Growth: Many Charleston homeowners have built significant equity, some doubling their home’s value in the last five years alone.

- Buying Power: That equity can help offset the impact of today's mortgage rates when purchasing your next home.

- Market Conditions: Inventory remains tight across all these areas, keeping demand strong for well-maintained properties.

- Refinance Opportunity: Should rates decline in the future, refinancing may provide additional financial flexibility.

🌟 Remember: Real Estate Is More Than Rates

You’re not just buying or selling a house—you’re making a move for your lifestyle, financial future, and peace of mind. Waiting for rates to drop while your equity sits idle can mean missing out on market opportunities that matter.

📞 Ready to Explore Your Options?

If you’re wondering whether now is the right time to sell or want help crunching the numbers, I’m here to provide clear, no-pressure advice tailored to your goals and the specific Charleston neighborhood you call home.

Let’s connect and frame your future—smartly and confidently.