Will the Fed’s 0.25% Rate Cut Lower Mortgage Rates in 2025?

Fed Rate Cut Explained: Why Mortgage Rates Don’t Always Follow

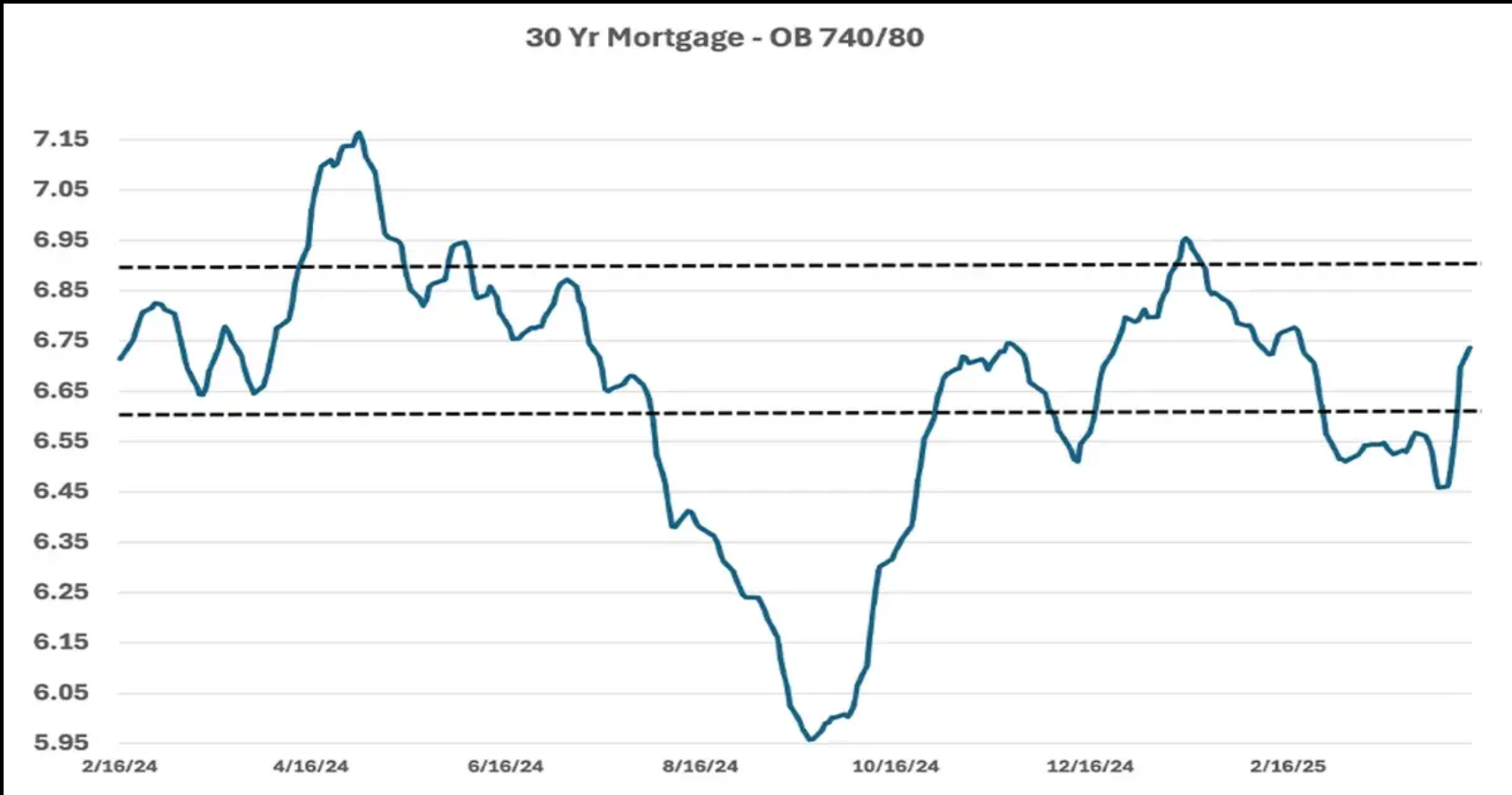

On September 17, the Federal Reserve announced a 0.25% cut to its benchmark interest rate. That headline grabbed attention — and I’ve already heard the question: “So, does that mean mortgage rates are lower now?”

The answer: not directly.

The Fed vs. Mortgage Rates: What’s the Difference?

- The Fed rate is the short-term rate banks use to borrow from each other overnight.

- Mortgage rates are long-term and move with the 10-year Treasury bond and the mortgage-backed securities market.

So while a Fed cut can influence mortgage rates, it doesn’t automatically make them drop. Sometimes mortgage rates even move before a Fed decision if markets expect it.

How Mortgage Rates Actually Move

The Fed controls the “short-term” side of interest rates. Mortgage rates, however, follow the “long-term” side — based mostly on the 10-year Treasury bond and what investors expect for the future of the economy.

In simple terms:

- The Fed sets the tone for short-term borrowing.

- Investors and markets decide long-term rates like mortgages.

That’s why mortgage rates don’t always fall when the Fed cuts. Sometimes they drop ahead of time if the market saw it coming, and sometimes they hardly budge at all.

What This Means for You

- Buyers: Don’t assume the Fed cut will make homes magically more affordable overnight. Mortgage rates are lower than they were earlier in 2025, but what matters most is today’s long-term rates and how they fit into your budget. If you’re sensitive to monthly payment swings, get pre-approved at current rates and ask your lender about rate lock windows and float-down options — these can help protect you if rates change before you close.

- Sellers: Well-priced homes may move faster with fewer incentives needed.

- Homeowners: If your current rate is much higher than today’s mid-6% levels, it may be worth checking if a refinance makes sense. Just make sure the savings outweigh the costs.

The Bottom Line

The Fed’s rate cut doesn’t directly set mortgage rates, but it can help push them in the right direction. Right now, mortgage rates have dipped into the mid-6% range — creating an opportunity for both buyers and homeowners to explore their options.

If you’re wondering what this means for you, the best step is to connect with a lender who can show you the numbers based on your budget and goals. If you need recommendations for trusted local lenders here in Charleston, feel free to reach out — I’m happy to connect you with experts who can guide you through your options.