Home Equity Hits New Highs Nationwide—What Buyers and Sellers Should Know in 2025

National Home Equity Gains Reach $140K+ Despite Slower Sales—How Does Charleston Compare?

📈 National Housing Snapshot: Equity Soars, Sales Stall

In a surprising twist for 2025, U.S. homeowners are enjoying record-high equity gains, despite slower home sales and growing affordability challenges. According to the National Association of REALTORS®, existing-home sales dipped 2.7% in June, yet the average homeowner has gained over $140,900 in equity over the past five years.

This growing wealth gap between homeowners and renters is becoming a dominant storyline in the national housing market—one with major implications for buyers, sellers, and anyone considering a move.

💰 National Highlights: Wealth Up, Movement Down

- Sales Are Cooling, But Values Aren’t

Home sales are tracking at just under 4 million annually, the lowest in nearly a decade. Still, the median national home price reached $435,300, a record high and a 2% increase from last year. - Equity Is Up Nearly Everywhere

Thanks to home appreciation over the last five years, the average U.S. homeowner gained $140K+ in equity. In fact, nearly half of homeowners now have mortgages that account for less than 50% of their home’s value—making them “equity rich.” - Renters Falling Behind

The contrast is sharp: the median net worth of homeowners is now projected around $430,000, compared to just $10,000 for renters.

🧠 Key Insights for Buyers, Sellers & Investors

- Sellers May Be Sitting on Untapped Potential

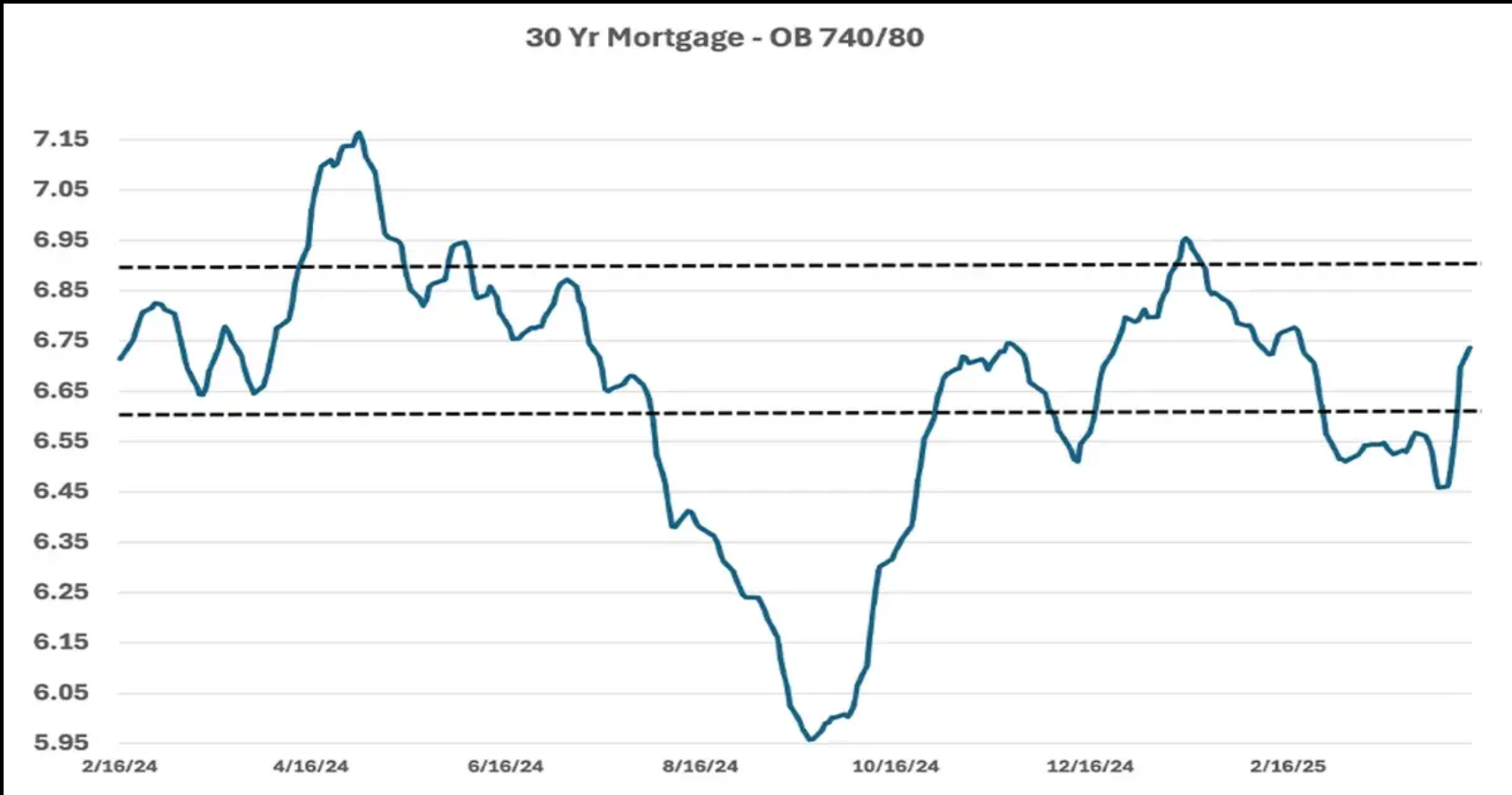

Many are unaware of just how much equity they’ve built. For those considering a move or downsizing, now might be the time to leverage that wealth—before any potential market shift. - Buyers Face Tougher Conditions

High home prices and mortgage rates near 7% are squeezing affordability, especially for first-time buyers who now make up just 30% of transactions (down from the historic 40%). - Investors Are Watching Closely

As equity climbs, investors are analyzing where appreciation is strongest. Many are targeting equity-rich markets for flips or long-term holds.

⚠️ National Outlook: What Comes Next?

While equity remains strong, this isn’t an all-clear signal for everyone:

- Affordability Remains a Drag

Price-to-income ratios are still stretched. High interest rates continue to keep many would-be buyers on the sidelines. - Inventory Is Stubbornly Low

Many homeowners, locked into 3% mortgage rates, are reluctant to sell—keeping national inventory suppressed and prices elevated. - Not All Regions Are Equal

While Northeast markets (like Boston and Philly) saw strong equity gains, parts of the South and West experienced flat or declining equity. Location continues to matter—a lot.

📍How Does Charleston Compare?

While the national market is experiencing slower home sales but record-high equity growth, Charleston continues to stand out with resilient buyer demand and steady appreciation—especially in high-demand micro-markets like Mount Pleasant, Daniel Island, and downtown.

Unlike markets that have seen softening prices, Charleston’s limited inventory and strong inbound relocation traffic have helped contribute to increasing property values in 2025. This means many local homeowners may be sitting on even more equity than the national average—and many buyers are still facing intense competition in desirable neighborhoods.

✅ Final Takeaway

Home equity across the U.S. has never been higher—creating opportunities for strategic sellers, cautious buyers, and informed investors. But every market is unique. If you’re curious how your Charleston home compares to national trends—or wondering whether it’s the right time to buy, sell, or simply stay put—I can help.

👉

Let’s take a closer look at your equity position, your timing, and your goals.

Contact me today for a personalized market analysis or just to get your questions answered—no pressure, just expert guidance.