Why the Fed Held Interest Rates in Late July 2025 — What It Means for Charleston Home Buyers

Fed Holds Rates at 4.25–4.50%: What It Means for the Charleston Housing Market

What the Federal Reserve Did — And Why It Matters

On July 30, 2025, the Federal Reserve voted to keep interest rates unchanged at a target range of 4.25% to 4.50%. This marks the fifth consecutive meeting with no rate change. According to reporting from CNBC, the Fed remains cautious as it watches key indicators like inflation, employment data, and the possible economic effects of recently proposed trade tariffs.

Notably, two voting members of the Fed — Governors Michelle Bowman and Christopher Waller — dissented, stating they would have preferred a 0.25% rate cut. Their argument? That the economy is showing signs of cooling, particularly in the labor market, and inflation is hovering near the Fed’s 2% target.

Fed Chair Jerome Powell, however, reinforced that while inflation has improved, it’s still slightly above ideal. The committee wants more time and more economic data before making further moves, especially as the broader global economy adjusts to ongoing trade policy changes.

What This Means for Charleston Home Buyers and Sellers

As a full-time Charleston Realtor who studies both national economics and hyperlocal housing trends, here’s how this decision directly impacts buyers and sellers in our area:

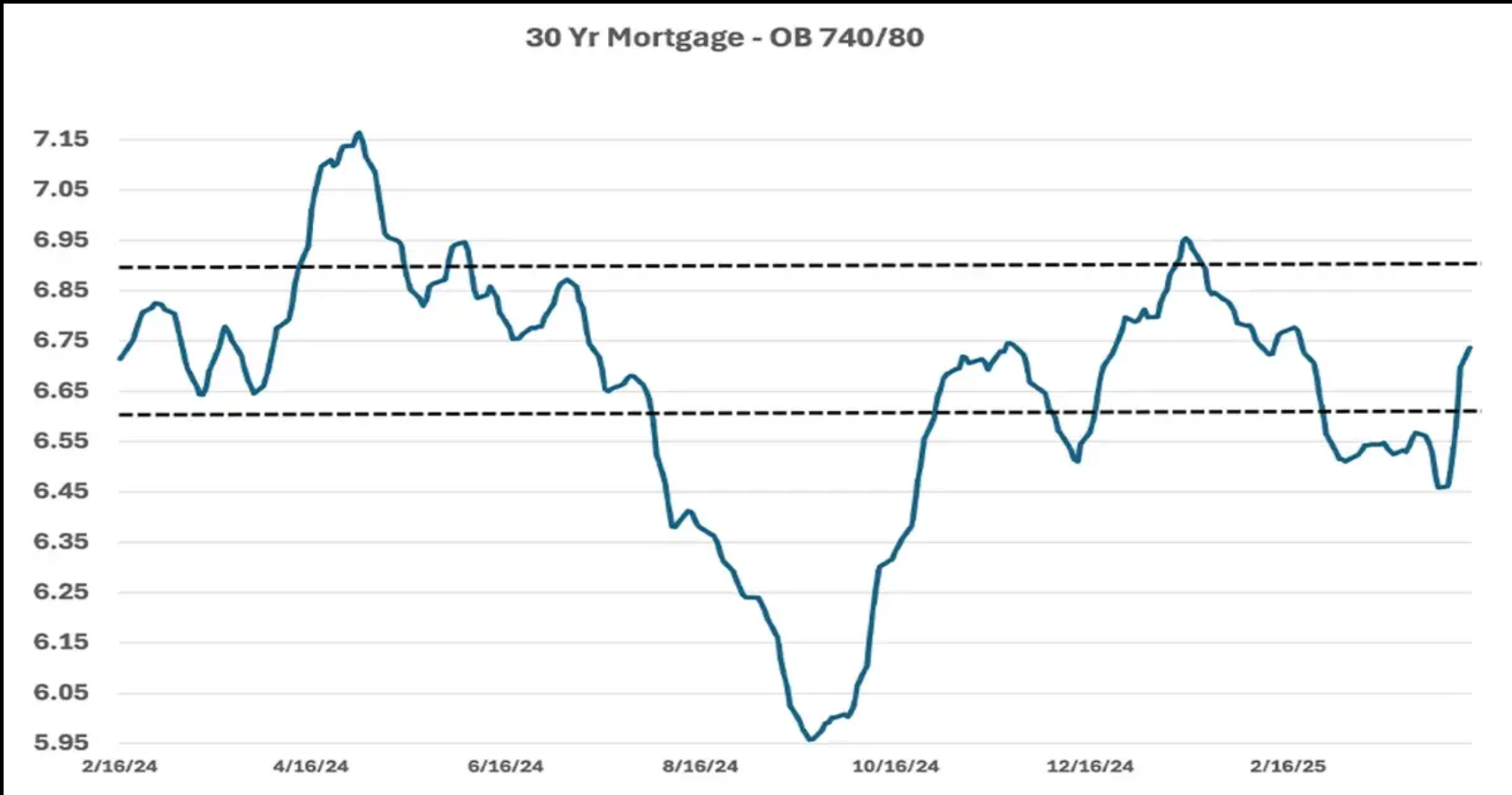

1. Mortgage Rates Likely to Stay Elevated — For Now

Holding the federal funds rate steady doesn’t directly set mortgage rates, but it absolutely influences them. Since the Fed paused again, we’re likely to see mortgage rates in the 6%–7% range continue, depending on buyer qualifications. That means home affordability is still a challenge for some, especially first-time buyers in competitive Charleston markets like Mount Pleasant or West Ashley.

2. Sellers: Pricing Strategy Matters More Than Ever

Higher rates mean smaller buyer pools. If you’re listing your home, proper pricing from day one is critical. The days of pushing the ceiling are gone — buyers are choosy and price sensitive, especially in areas with more inventory like parts of Summerville

or North Charleston.

3. Buyers: Be Ready to Negotiate

Sellers are increasingly open to concessions. I’m seeing more deals where buyers are securing rate buydowns or closing cost credits — especially on homes that have been on the market a few weeks

or months.

If you're thinking about making a move, you might be able to negotiate more favorably now than when rates eventually drop and competition floods back in.

4. Uncertainty Means Staying Agile

The Fed is in “wait and see” mode. If inflation continues trending down and employment weakens further, we may see rate cuts later this year — possibly as early as the September meeting. Until then, I’m watching the data closely and advising my clients accordingly. Whether it’s time to lock in a mortgage rate, make a move, or wait it out depends on your individual goals and the micro-market you're buying or selling in.

Charleston Market Insight from a Local Expert

What makes Charleston real estate unique is that national headlines don’t always apply cleanly to what’s happening here on the ground. Yes, the Fed’s decisions shape the overall lending environment — but local inventory, neighborhood demand, and seasonal patterns can move independently.

In July and early August, we typically see a surge in buyer activity before things cool off slightly in early fall. So while interest rates may stay elevated in the short term, many sellers still want to capitalize on the late summer buyer window.

Whether you're relocating to Charleston, moving within the area, or just starting to explore the market, I help clients understand not just where rates are today — but how those numbers fit into the bigger picture of lifestyle, equity growth, and long-term strategy.

Final Thoughts

The Federal Reserve’s July decision to hold rates steady is just one piece of the puzzle. What matters most is how those macroeconomic shifts influence real-time decisions in the Charleston housing market.

I track the national headlines, decode what they mean for our area, and help buyers and sellers make confident, informed decisions every day. If you're thinking about making a move or simply want to understand how rate trends could affect your next steps, let’s talk. You deserve a Realtor who can read the national market — and still explain what it means for your street.

**Sources Referenced:

- CNBC, July 30, 2025: “Fed leaves interest rates unchanged, as expected”

- Remarks from Federal Reserve Chair Jerome Powell (post-meeting press conference)

- Voting commentary from Fed Governors Michelle Bowman and Christopher Waller